No restrictions on senior’s voluntary superannuation contributions

The restrictions on people over 65 years old making voluntary contributions for a period after they have stopped working in the new superannuation reform package should be lifted according to Council on the Ageing (COTA).

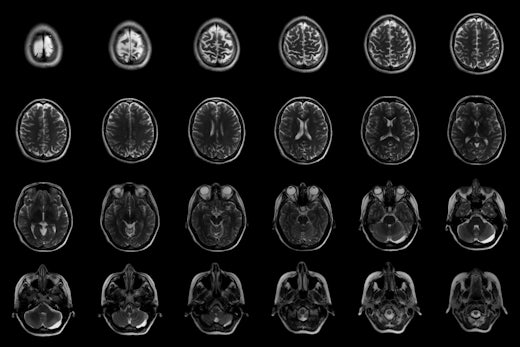

The Government claims the reform package will make it possible for Australians to manage their superannuation and plan their retirement with certainty (Source: Shutterstock)

The Treasury Laws Amendment (Fair and Sustainable Superannuation) Bill 2016 and Superannuation (Excess Transfer Balance Tax) Imposition Bill 2016, recently passed through parliament is expected to save the budget around $2.8 billion.

The Government claims 96 percent of individuals with superannuation will either not be affected by these changes or will be better off. The majority of the 4 percent of individuals that are adversely affected by these changes are unlikely to rely on the Age Pension in retirement.

COTA welcomes the changes and thinks the reform package fairer and more sustainable, however COTA Australia Chief Executive Ian Yates believes the changes could have gone further in terms of fairness.

He expressed disappointment that the vested interests of a few wealthy retirees and the politics of the time resulted in the watering down of the original provisions announced in the May 2016 federal Budget.

“In particular COTA is greatly concerned that the fair and sensible Budget measure to lift restrictions on 65-74-year-olds making voluntary contributions to superannuation without having to be qualified under the work test has been lost along the way,” says Mr Yates.

He believes this measure would have enabled people who have not fully provisioned for their retirement to still do after they have ceased working.

“It also would have encouraged people to consider utilising some of the equity invested in their primary place of residence for their retirement living; enabling a better standard of living and independence,” he says.

The Government claims the reform package will make it possible for Australians to manage their superannuation and plan their retirement with certainty and it will also provide certainty for the superannuation industry, allowing it to implement the reforms by 1 July 2017.

Other measures in the package include a $1.6 million cap on the amount of tax-free super savings a person can hold in retirement from July next year and after-tax contributions capped at $100,000 a year.

![The new Aged Care Act exposure draft is slated for release in December of 2023, but advocates hope to see it rolled out on January 1, 2024. [Source: Shutterstock]](https://agedcareguide-assets.imgix.net/news/articles/wp/agedcareact__0811.jpg?fm=pjpg&w=520&format=auto&q=65)

Comments