New PM announces plan to scrap proposed pension age increase

The new-look Federal Government is set to abandon the previous plan to raise the age pension access age to 70, in a welcomed decision announced by Prime Minister Scott Morrison during an interview with Nine Network.

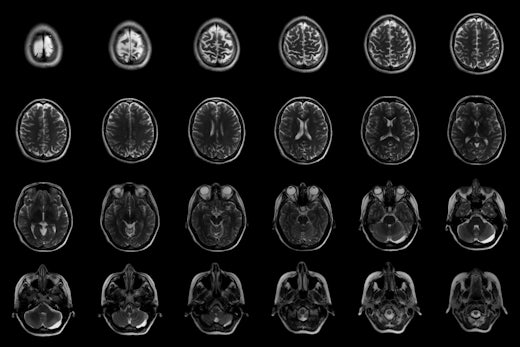

The Australian age pension access age will remain at 67 according to the new PM (Source: Shutterstock)

Mr Morrison made the surprise announcement, that is yet to be formally approved by Government, in response to a viewer’s question on The Today Show.

The policy to lift the pension age to 70 was announced by former Treasurer Joe Hockey in his controversial 2014 Budget – the first budget of the Abbott Government – with Mr Hockey stating at the time “we must prepare for the adjustments in our society”. The plan was for the age of the pension to increase by six months every two years until it reached 70 in 2035.

The increase, although never legislated, remains a topic of controversy.

“I don’t think we need that measure any longer when it comes to raising the pension age,” Mr Morrison says.

“I was going to say this next week but I may as well say it here…next week, Cabinet will be ratifying the decision to reverse taking the pension, the retirement age, to 70. It will remain at 67.

“The pension age going to 70, gone.”

The qualifying age for the pension currently sits at 65 years and six months and will rise by six months every two years until 2023 where it will reach 67 years, a policy foreshadowed in the 2009 Labor Budget. Since the age pension was introduced in 1908, access has always remained at 65 years of age, until now.

Peak advocacy group National Seniors has welcomed Mr Morrison’s decision, with Chief Advocate Ian Henschke saying raising the retirement age to 70 represented widespread discrimination across the older community.

“Every second voter in Australia is now aged over 50 and being told they might have to work past 67 was not well received,” Mr Henschke says.

“Even workers as young as 50 find it hard to secure work if they lose their job through redundancy or for some other reason.”

Mr Henschke reminds people to take into consideration those working physically demanding jobs who are not capable of working past 70.

“People who are involved in manual or physically demanding jobs are often not capable of working until they are 70,” he continues.

“Imagine being a construction worker, labourer, or a nurse and being told you’re not eligible for a pension.

“We [also] know many older workers end up on Newstart because they just can’t get a job.

“In fact 25 percent of people on Newstart are aged over 55 and unemployed Australians aged 60-64 are on unemployment benefit, on average, almost twice as long as those aged 25-29.”

South Australian resident Rod McDowall is in his 60s and knows all too well the struggle of finding employment, and working in a physically demanding job, later in life, and says it is a “relief” to know that the pension and retirement age is not increasing to 70.

“I think the decision to keep the retirement and age pension age at 67 is a good idea because for those of us in physically demanding jobs, it is hard to keep up as we age,” he explains.

“Working outside, temperature, shift work and even getting up gets harder – anything that’s not in an office – is getting harder and I notice it now that I’m in my 60s.

“So yes, it is reassuring to know that I won’t be forced to work until I’m 70 if I am unable to, and as someone who is only in casual shift work since being made redundant from my job of 24 years a few years back, having the pension age remain gives me some assurance for the future.”

Fellow national peak body for older Australians, Council on the Ageing (COTA) has also spoken out on the pension age change take-back, calling for the focus to now switch to measures to support mature employment and tackle age discrimination.

COTA Chief Executive Ian Yates says Australia’s pension and retirement incomes system must be sustainable, but not at the expense of the wellbeing of older Australians who are already experiencing discrimination.

“The Government’s ‘More Choices for a Longer Life’ package in the Federal Budget is the right approach to mature age employment – providing a package measure including fighting ageism in the workforce, job subsidies, career review and reskilling programs, better job placement, support to older entrepreneurs, and incentives to keep working while on the pension,” Mr Yates says.

“There is no point in raising the pension age further when people who want to work longer are too often locked out of even being considered for jobs because of persistent ageism and discrimination.

“Australia needs to invest in its older population who contribute enormously to the economy and society but could add even more substantially to economic growth and social cohesion if properly supported.”

![The new Aged Care Act exposure draft is slated for release in December of 2023, but advocates hope to see it rolled out on January 1, 2024. [Source: Shutterstock]](https://agedcareguide-assets.imgix.net/news/articles/wp/agedcareact__0811.jpg?fm=pjpg&w=520&format=auto&q=65)

Comments