Government incentives not enough to encourage older Australians to downsize

A new report which has revealed that despite downsizing measures being included in the 2017-18 Federal Budget, more than 40 percent of older Australians will still choose not to make the move.

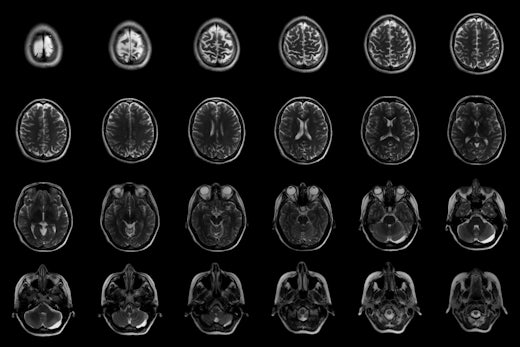

Only 17 percent of older Australians say a government initiative that could boost their superannuation would encourage them to downsize (Source: Shutterstock)

The report, Downsizing: Movers, planners and stayers, by seniors advocacy group National Seniors, shows that while almost 90 percent of planners were aware of the Budget measure, active from July 2018, which offers the chance to put $300,000 per person from the sale proceeds of their home into superannuation, only 17 percent say the initiative would encourage them to downsize.

Findings from the report also show that the 42.1 percent of retirees who want to stay where they are, are choosing to stay for the memories of the kids growing up, and the space for hobbies and their children and grandchildren to come and stay.

Report author Dr Karen Rees says that the figures of those who are encouraged to downsize would increase to just under a quarter if the sale proceeds of their home were exempt from the Age Pension means test.

“So, it appears the government’s Budget initiative is not a strong incentive to downsize, and National Seniors’ ‘Rightsizing’ policy, that would enable up to $250,000 of excess sale funds to be quarantined from the Age Pension means test, is more on track,” she says.

A spokesperson for the Treasurer says the initiative is to help free up larger homes for younger families.

“From 1 July 2018, older Australians considering downsizing will be given the flexibility to contribute up to $300,000 from the sale proceeds of their home into superannuation as a non-concessional contribution,” the spokesperson says.

“Both members of a couple can take advantage of this measure, meaning up to $600,000 of contributions may be made by a couple from the proceeds of selling their home.”

The spokespersons says this incentive will “encourage people, who may have been put off by existing restrictions and caps, to move house and free up larger homes for growing families”.

Dr Rees says that the report also saw three distinct categories for Australian retirees; the movers, the planners and the stayers.

For those participants who were keen to downsize, the planners, the report made note of two key financial disincentives that affected their decision: transaction costs such as stamp duty; and the possibility they could lose their Age Pension and associated concessions on expenses such as transport, power, rates and water.

“Our research showed that 33.9 percent of retirees are movers – they have already downsized – and 25 percent are planners – moving to a smaller home is something they plan to do as they age,” she explains.

“The reasons to downsize in retirement usually revolve around not being physically able, or finding it too costly, to maintain the home and yard; the need for a single-level home because using the stairs is difficult; and the desire to use the sale proceeds to maintain their lifestyle or to travel.

“Another key factor in deciding to downsize is the death of a spouse or relationship breakdown.

“But 42.1 percent are stayers, and many say the only way they’d downsize is if they are forced to by financial hardship or the loss of their partner.”

In the submission stage, fellow seniors advocacy group Council on the Ageing (COTA) raised their concerns from their members and general public to the then proposed and now implemented scheme.

The submission from COTA Chief Executive Officer Ian Yates states that those most likely to benefit from the scheme are wealthier downsizers: “A key response from our members and the older general public to the proposed scheme has been a concern that taking up the option might compromise their Age Pension eligibility by resulting in them exceeding the limits of the Pension income or asset tests.

“Therefore, we consider that those most likely to take up and benefit from the measure will be wealthier downsizers who would not qualify for the Age Pension in any case, especially given that the downsizing contribution will not count towards the superannuation non-concessional cap.”

In the submission Mr Yates also shared COTA’s interest in seeing a “post-implementation evaluation of the measure, especially regarding the type of households taking up the option.”

![The new Aged Care Act exposure draft is slated for release in December of 2023, but advocates hope to see it rolled out on January 1, 2024. [Source: Shutterstock]](https://agedcareguide-assets.imgix.net/news/articles/wp/agedcareact__0811.jpg?fm=pjpg&w=520&format=auto&q=65)

Comments