Age of intending retirees goes up

Changes in pension eligibility, superannuation rules and economic uncertainty are factors attributed to pushing up the age of people intending to retire in the next 12 months.

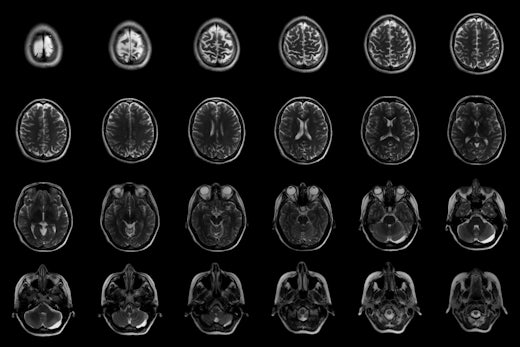

The average age of Australians intending to retire in the next 12 months has gone up from 58 to 61 years (Source: Shutterstock)

Figures released by Roy Morgan’s Single Source survey show the average age of Australians intending to retire in the next 12 months is 61 years, up from 58 years over the last two years (2014).

The increased average age of intending retirees has also reduced their number in the next 12 months to 395,000, down from 411,000 in 2014.

This increase in retirement age could be good for the government and superannuation funds, as it means both government and superfunds paying out less. However, the drawback of delayed retirement is it may increase unemployment, with older workers occupying positions younger people might otherwise have filled.

The survey has also revealed the average gross wealth (excluding owner-occupied homes) of intending retirees has risen by 3.6 percent since 2014, from $276,000 to $286,000. The average debt level of only $18,000 for this group is not a major problem and reduces the average net wealth to $268,000.

However, while the gross wealth has increased, the survey points out superannuation is playing an increasing role in retirement funding, accounting for 62.9% of gross wealth of intending retirees, up from 57.6% in 2014.

Despite this increase, there are still major potential for superannuation funds to attract additional after-tax funds from many of their members.

Norman Morris, Industry Communications Director, Roy Morgan Research

says the average level of savings and superannuation for those intending

to retire in the next 12 months is well below the new age pension asset

eligibility levels announced recently by the Australian Government and

he believes pressure on government funding will continue for some time

yet.

“Many intending retirees are holding a substantial portion of their

savings outside of superannuation; this represents a major growth

opportunity for superannuation funds and potential long-term improvement

in fund members’ financial position,” he says.

“Large funds held

outside of superannuation for those close to retirement may be due to

their not understanding the benefits, not qualifying to make additional

deposits, being unsure about superannuation with all its rule changes,

or simply wanting to stay flexible.”

Mr Morris believes the government needs to play a greater education

role to enable well informed retirement funding decisions, highlighting

superannuation is a very long-term investment which is made more

difficult by regular rule changes.

“Intending retirees who own or are paying off their home have a major

potential source of retirement funding compared with those who rent,

but there is partial recognition of this problem as non-homeowners have

higher asset limits than homeowners when it comes to the assets test for

pension eligibility,” he says.

![The new Aged Care Act exposure draft is slated for release in December of 2023, but advocates hope to see it rolled out on January 1, 2024. [Source: Shutterstock]](https://agedcareguide-assets.imgix.net/news/articles/wp/agedcareact__0811.jpg?fm=pjpg&w=520&format=auto&q=65)

Comments